Accounting & Finance I Assignments (subject to change)

- Accounting & Finance 1 Assignments

- Google Classroom

- Text Book

- Workplace Readiness Prep

- Syllabus

- Old Youtube Videos 1

- Youtube Videos 2

- Youtube Videos 3

- Objective: Review and reinforce journalizing with special journals and payroll activities

- For a grade: Have your journals and ledgers checked on specified dates.

- Dec 8, 14, 20, 29, 31

- The transaction on Dec 28 will be journalized in the Cash Payments Journal.

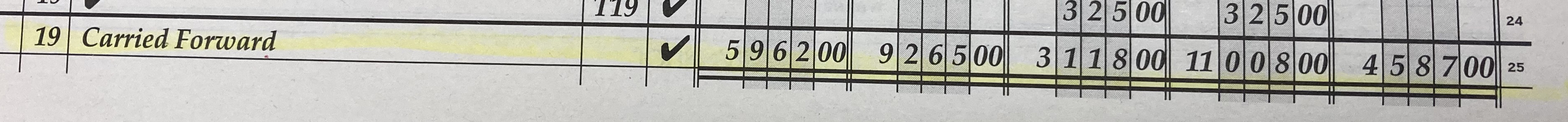

- Journal totals

May 24

Reinforcement 2A

May 11

Chapter 13: Accounting for Payroll and Payroll Taxes

- Learning Objectives After studying Chapter 13, in addition to defining key terms, you will be able to:

- LO1 Analyze a payroll transaction.

- LO2 Journalize a payroll including employee payroll taxes.

- LO3 Calculate and record employer payroll taxes.

- LO4 Prepare selected payroll tax reports.

- LO5 Pay and record withholding and payroll taxes.

- Work Togethers can be seen using the Youtube channels above

- Submit assignments as follows

- Work Together 1-2 (do not submit)

- Submit

- Study Guide

- Problem 1 and 2

- Problem 3

- Problem 4 and M

- PDF Key for Work Together Problems and some of the problems to check your work.

May 9-10

Chapter 12: Preparing Payroll Records

- Recycling Problem

- To be done in class only.

May 8

DUE: Chapter 12

April 25

Chapter 12: Preparing Payroll Records

- Learning Objectives After studying Chapter 12, in addition to defining key terms, you will be able to:

- LO1 Explain how employees are paid.

- LO2 Calculate hourly employee earnings.

- LO3 Demonstrate the process for determining federal income tax withholdings.

- LO4 Demonstrate the process for calculating social security and Medicare taxes.

- LO5 Explain the benefit of funding medical and retirement plans with pretax contributions.

- LO6 Prepare a payroll register.

- LO7 Prepare employee earnings records.

- LO8 Justify the use of a payroll checking account.

- LO9 Prepare employee payroll checks.

- Submit assignments as follows

- Study Guide.

- Work Together and On Your Own Problems

- Problems 1, 2, 3, 4, M, C

- Please submit 1, 2-4, M, C

- PDF Key for Work Together Problems and some of the problems to check your work.

Mar 30

Chapter 11: Accounting for Transactions Using a General Journal (prev Feb 12)

- Learning Objectives After studying Chapter 11, in addition to defining key terms, you will be able to:

- LO1 Explain the purpose of a general journal.

- LO2 Account for purchases returns and allowances.

- LO3 Post a general journal to the accounts payable ledger and general ledger.

- LO4 Account for sales returns and allowances.

- LO5 Post a general journal to the accounts receivable ledger and general ledger.

- LO6 Record a correcting entry to the accounts receivable ledger.

- LO7 Explain the relationship between retained earnings and dividends.

- LO8 Account for the declaration and payment of dividends.

- Submit the following separate from each other

- Study Guide.

- Work Together and On Your Own Problems p326, 331, 336

- Application Problems 1-2

- Submit each as you are done. It will be checked and returned.

- Problem 3-M.1

- PDF Key for Work Together Problems and some of M.1 to check your work

- Problem M.2

- Problem C

Feb 27

Chapter 10: Accounting for Sales and Cash Receipts

- Learning Objectives After studying Chapter 10, in addition to understanding key terms, you will be able to:

- LO1 Explain the relationship between the accounts receivable ledger and its controlling account.

- LO2 Record sales on account using a sales journal.

- LO3 Post sales on account to an accounts receivable ledger and a general ledger.

- LO4 Record cash and credit card sales using a cash receipts journal.

- LO5 Journalize cash receipts on account using a cash receipts journal.

- LO6 Post cash receipts to an accounts receivable ledger and a general ledger.

- LO7 Prepare a schedule of accounts receivable.

- Submit the following separate from each other

- Study Guide

- Work Together Problems 1-4

- Problems 1-4

- Submit after each problem

- Problem M

- Submit by itself

- Problem S

- Submit by itself

- Problem C

- Problem C: Skip page 267

- Example Transaction:

- 3. Received a check for $2,947.77 from Jenson College in full payment of S894. R948.

- The directions say: Innovative Technology records the sales invoice number in the Item column of the accounts receivable ledger forms. When a customer pays an invoice, determine whether any claimed discount is earned (received within ten days of the sale) or unearned (received after ten days). Look in the Ledger to see the date of Guidethe original invoice.

- For this transaction, the sale occurred on Nov 24. Therefore, they are paying within the 10 days and getting the discount.

- The amount of the original invoice is $3007.93. This is from the AR Ledger.

- Because of this, we need to journalize an AR Credit for 3007.93, a Sales Discount Debit for 60.16 and a Cash Debit of 2947.77.

- For each transaction, you have to have something in the cash column since it is the cash receipts journal.

- Based on when they are paying you, you must look in the ledger to see when the original transaction took place.

- For example, if they are paying you on the 26th but the purchase listed in the ledger was on the 10th; they do not get a discount. If they pay on the 28th and the ledger shows the purchase on the 20th they are within the 10 days and get a discount.

- However, some are taking the discount even though they are paying after the 10 days. This is where the unearned discount comes in to play.

- 3. Received a check for $2,947.77 from Jenson College in full payment of S894. R948.

- PDF Key for Problem C to check your work

Feb 20

Chapter 9: Accounting for Purchases and Cash Payments

- Recycling Problem

Feb 2

Chapter 9: Accounting for Purchases and Cash Payments

- Learning Objectives After studying Chapter 9, in addition to defining key terms, you will be able to:

- LO1 Distinguish among service, retail merchandising, and wholesale merchandising businesses.

- LO2 Identify differences between a sole proprietorship and a corporation.

- LO3 Explain the relationship between a subsidiary ledger and a controlling account.

- LO4 Describe accounting procedures used in ordering merchandise.

- LO5 Discuss the purpose of a special journal.

- LO6 Journalize purchases of merchandise on account using a purchases journal.

- LO7 Post merchandise purchases to an accounts payable ledger and a general ledger.

- LO8 Record cash payments using a cash payments journal.

- LO9 Record replenishment of a petty cash fund. LO10 Post cash payments to an accounts payable ledger and a general ledger.

- Submit the following separate from each other

- Study Guide

Jan 31

Chapter 8 Test

- Learning Objectives After studying Chapter 8, in addition to defining key terms, you will be able to:

- LO1 Journalize and post closing entries for a service business organized as a proprietorship.

- LO2 Prepare a post-closing trial balance.

Jan 27

DUE: Reinforcement 1B:

- Objective: Review the second half of the accounting cycle.

Jan 24

Reinforcement 1B:

- Objective: Review the second half of the accounting cycle.

- Use Part A to complete Part B: Video Explanation

- Complete test at end of reinforcement.

- To submit, staple Part A on top of Part B. Do not staple the test.

Jan 17

Chapter 8: Recording Closing Entries and Preparing a Post-Closing Trial Balance for a Service Business

- Learning Objectives After studying Chapter 8, in addition to defining key terms, you will be able to:

- LO1 Journalize and post closing entries for a service business organized as a proprietorship.

- LO2 Prepare a post-closing trial balance.

- Recycling Problem

Jan 5

Chapter 8: Recording Closing Entries and Preparing a Post-Closing Trial Balance for a Service Business

- Learning Objectives After studying Chapter 8, in addition to defining key terms, you will be able to:

- LO1 Journalize and post closing entries for a service business organized as a proprietorship.

- LO2 Prepare a post-closing trial balance.

- Study Guide

- As a class

- Work Together 1 p222: Demonstration video

- Work Together 2 p230: Demonstration video

- On Your Own p222, p230 Show me this to get credit.

- Problems

- Problems 1, 2, M, C

- Submit Problems 1, 2 and M together; C alone.

Dec 14

Chapter 7: Financial Statements for a Proprietorship

- Learning Objectives After studying Chapter 7, in addition to defining key terms, you will be able to:

- LO1 Prepare an income statement for a service business.

- LO2 Calculate and analyze financial ratios using income statement amounts.

- LO3 Prepare a balance sheet for a service business organized as a proprietorship.

- As a class

- 1 Together Video

- 2 Together Video

- 1 On your own

- 2 On your own

- Problems

- Study Guide

- Problems 1-2, M, C

- Submit 1, 2 and M together, C

- Recycling (Optional-some Extra Credit)

Dec 14

DUE: Chapter 6: Recycling Problem

Dec 13

Chapter 6: Recycling Problem

- Objective: Use correct procedures to plan adjustments and prepare a worksheet for a service business

Nov 30

Chapter 6: Work Sheet and Adjusting Entries for a Service

- Learning Objectives After studying Chapter 6, in addition to defining key terms, you will be able to:

- LO1 Prepare the heading of a work sheet.

- LO2 Prepare the trial balance section of a work sheet.

- LO3 Analyze and explain the adjustments for supplies and prepaid insurance.

- LO4 Complete the Adjustments columns of a work sheet.

- LO5 Prepare the Balance Sheet and Income Statement columns of a work sheet.

- LO6 Total and rule the work sheet.

- LO7 Apply the steps for finding errors on a work sheet.

- LO8 Journalize and post the adjusting entries for supplies and prepaid insurance.

- As a class

- Work Together Problems 1-4

- Explanation video 1: Trial Balance and Adjustments

- Explanation video 2: Income Statement and Balance sheet columns

- Explanation video 3: Net income and ruling

- Explanation video 4: Work Together Problem 4

- On Your Own Problems 1-4 (Show me for credit)

- Work Together Problems 1-4

- Problems 1-4, M, C

- Submit Problems 1-3. These will be checked in class and returned.

- Submit Problem 1-3, 4 and M

- Submit Problem C

Nov 29

DUE: Reinforcement 1 A

Nov 15

Reinforcement 1 A

- Objective: Review the first half of the accounting cycle.

DUE: Chapter 5

Nov 11

Chapter 5: Recycling Problem (SKIPPED IN 2022-2023)

- Objective: Understand the process to reconcile a bank statement

Nov 3

Test Chapter 4 Recycling Problem

Nov 2

Quarter 2 Pretest

- Reinforcement 1 A and B Test

Nov 1

Chapter 5

- Learning Objectives After studying Chapter 5, in addition to defining key terms, you will be able to:

- LO1 Record a deposit on a check stub.

- LO2 Endorse checks using blank, special, and restrictive endorsements.

- LO3 Prepare a check stub and a check. LO4 Complete a bank statement reconciliation.

- LO5 Record and journalize a bank service charge.

- LO6 Complete recordkeeping for a dishonored check.

- LO7 Journalize an electronic funds transfer.

- LO8 Journalize a debit card transaction.

- LO9 Establish a petty cash fund.

- LO10 Prepare a petty cash report.

- LO11 Replenish a petty cash fund.

- Study Guide

- As a class

- Problems

- Problem 1

- Problems 2-3

- Problem 4, M, C

Oct 31

DUE: Quarter 1 Final: Chapter 4 Test

- Objective: Journalize and post transactions from the general journal to the general ledger

Oct 26

Quarter 1 Final: Chapter 4 Test

- Objective: Journalize and post transactions from the general journal to the general ledger

Oct (SKIPPED 2022-2023)

DUE: Chapter 4 Recycling Problem

- Objective: Journalize and post transactions from the general journal to the general ledger

Oct (SKIPPED 2022-2023)

Chapter 4 Recycling Problem

- Objective: Journalize and post transactions from the general journal to the general ledger

Oct 11

Chapter 4

- Learning Objectives After studying Chapter 4, in addition to defining key terms, you will be able to:

- LO1 Construct a chart of accounts for a service business organized as a proprietorship.

- LO2 Demonstrate correct principles for numbering accounts.

- LO3 Apply file maintenance principles to update a chart of accounts.

- LO4 Complete the steps necessary to open general ledger accounts.

- LO5 Post amounts from the General Debit and General Credit columns of a journal.

- LO6 Post column totals from a journal to ledger accounts.

- LO7 Analyze incorrect journal entries and prepare correcting entries.

- LO8 Demonstrate how to correct errors made during the posting process.

- Study Guide

- As a class

- Problems

- 1-3, M, S, C p117-119

- Submit Problems 1-3 together,

- Problems 4, M, S together,

- Submit C

- Recycling Problem

Oct SKIPPED 2022-2023

Test Chapter 3

- Objective: Record accounting transactions in a general journal.

- DUE: OCTOBER 12

Oct 10

DUE: Recycling Problem 3

Oct 7

DUE: Chapter 3 Problems

Recycling Problem 3

Sep 16

DUE: Recycling Problem 2

Chapter 3: Record accounting transactions in a general journal.

- Learning Objectives After studying Chapter 3, in addition to defining key terms, you will be able to:

- LO1 Define what a journal is and explain why it is used to record transactions.

- LO2 Compare and contrast different types of source documents.

- LO3 Identify the four parts of a journal entry.

- LO4 Analyze and record cash transactions using source documents.

- LO5 Analyze and record transactions for buying and paying on account.

- LO6 Analyze and record transactions that affect owner’s equity.

- LO7 Analyze and record sales and receipt of cash on account.

- LO8 Prove and rule a journal.

- LO9 Demonstrate how to prove cash.

- LO10 Identify and correct errors using standard accounting practices.

- Problems

- Study Guide

- As a class

- Work Together problems 1-4

- On Your Own problems 1-4

- Application Problems 1-4.2, M, S, C

- Submit

- 1-4.1

- 4.2, M, S

- C

Sep 6

Chapter 2

- LO1 Show the relationship between the accounting equation and a T account.

- LO2 Identify the debit and credit side, the increase and decrease side, and the balance side of various accounts.

- LO3 Restate and apply the two rules that are associated with the increase side of an account.

- LO4 Restate and apply the four questions necessary to analyze transactions for starting a business into debit and credit parts.

- LO5 Analyze transactions for operating a business into debit and credit parts.Objective: Analyze how transactions affect the accounting equation

- Problems

- Study Guide

- Work Together 2-3

- On Your Own 2-3

- Application Problems 2-3, M, C

- Submit 2 by itself, 3 and M together and C by itself

Sep 1

DUE: Chapter 2 Recycling Problem

Aug 30

Quiz: Accounting T

Q1 Pretest Chapter 4 Test

DUE Chapter 1

- Only submit Probelms M and C

Chapter 2 Recycling Problem

Aug 24-26

Chapter 1: Analyze how transactions affect the accounting equation

-

LEARNING OBJECTIVES After studying Chapter 1, in addition to defining key terms, you will be able to:

- LO1 Describe the different users of accounting information.

- LO2 Prepare a net worth statement and explain its purpose.

- LO3 Classify accounts as assets, liabilities, or owner’s equity and demonstrate their relationship in the accounting equation.

- LO4 Analyze the effects of transactions on the accounting equation.

- LO5 Distinguish between cash and on account transactions.

- LO6 Compare and contrast the types of transactions that increase and decrease owner’s equity.

- LO7 Explain the difference between expenses and liabilities.

- Study Guide

- Problems

- Work Together 1, 2, 3

- On Your Own 2, 3

- 1-4, M, C

- Video: Help With Problem 1 and some totals

Aug 23

Accounting T notes for Quiz next week

Aug 22

Course requirements/expectations

- Syllabus: parents must reply to the email to respinola@hcsdnv.com for verification of syllabus.

Student Syllabus Verification

- Complete in Google Classroom

Join Quizlet

- https://quizlet.com/join/X4vU3V6h9?i=1ucocb&x=1rqt

- Use your real name for your Quizlet account so you can receive credit.