Consumer Finance Assignments (subject to change)

April 26

Chapter 3 Taxes: Worksheet Pages 19-20

- Objective: List and define basic tax terminology; Prepare tax forms.

- Complete using notes provided in class only

April 25

Test Chapter 10

- Complete in Google classroom

- Use any notes you may have.

Predatory lenders

- Objective: Understand the dangers posed with credit and what can be done to avoid them

- From www.nerdwallet.com: "Predatory lending occurs when a lender uses unfair or deceptive tactics to lead a borrower into taking a loan that carries terms that benefit the lender at the borrower’s expense."

- Read the directions in Google Classroom

April 24

Chapter 3: Taxes

- Objective: List and define basic tax terminology; Prepare tax forms.

- Submit Page 23: Ronald Mitchell 1040

- How much taxes would be collected (write next to line 10) using 2022 tables.

- 2022 IRS Tax Forms

- 2021 IRS Tax Forms

- 2020 IRS Tax Forms

- 2019 IRS Tax Forms

- 2018 IRS Tax Forms

- 2017 IRS Tax Forms

- 2016 IRS Tax Forms

- 2022 Tax Brackets

- 2021 Tax Brackets

- 2020 Tax Brackets

- 2019 Tax Brackets

- 2018 Tax Brackets

- 2017 Tax Brackets

- Historical Tax Brackets

Chapter 3: Taxes

- Objective: List and define basic tax terminology; Prepare tax forms.

- Chapter 3 Project

- Quiz: Tomeka Hunt Tax Return 1040EZ

- Complete the 1040EZ tax form for Tomeka Hunt using the information below.

- You should use page 21 as a reference.

- Print this. Form 1040EZ

Use the tax table below

- Quiz: Tomeka Hunt Tax Return 1040EZ

Apr 23

ACT Day: No School

Apr 22

Chapter 3: Taxes

- Objective: List and define basic tax terminology; Prepare tax forms.

- Worksheet Page 21

- Do not submit Page 21: Georgina Bales 1040

- How much taxes would be collected (write next to line 10) using 2022 tables in the 2022 Form 1040 instructions

- Video Explanation.

- Do not submit Page 21: Georgina Bales 1040

- 2022 IRS Tax Forms

- 2021 IRS Tax Forms

- 2020 IRS Tax Forms

- 2019 IRS Tax Forms

- 2018 IRS Tax Forms

- 2017 IRS Tax Forms

- 2016 IRS Tax Forms

- 2022 Tax Brackets

- 2021 Tax Brackets

- 2020 Tax Brackets

- 2019 Tax Brackets

- 2018 Tax Brackets

- 2017 Tax Brackets

- Historical Tax Brackets

Apr 19

Chapter 10

- Objective: Understand the dangers posed with credit and what can be done to avoid them

- Ch 10 Section 2 p231-236 Notes: Bankruptcy

- Notes video

Chapter 10 Worksheet

- Objective: Understand the dangers posed with credit and what can be done to avoid them

- Pages 91-92

- Submit each page separately. DO NOT STAPLE.

- Must be completed in class

- Use notes in Google classroom to complete

Apr 18

Quiz Chapter 10 Terms from Quizlet

Apr 17

Interest Calculations Worksheet 1 Makeup

- Objective: Understanding how to use credit wisely and calculate the cost of credit.

- Installment loan Calculation: https://youtu.be/hBGEYniGU6w?si=IYHqzJJDLnGOXkoI

Bankruptcy by Wall Street Survivor video and quiz

Apr 16

Redo as a Class: Interest Calculations Worksheet 1

Quizlet Chapter 10: Problems with Credit

Apr 15

Fourth Quarter Pretest: Balancing a Checkbook

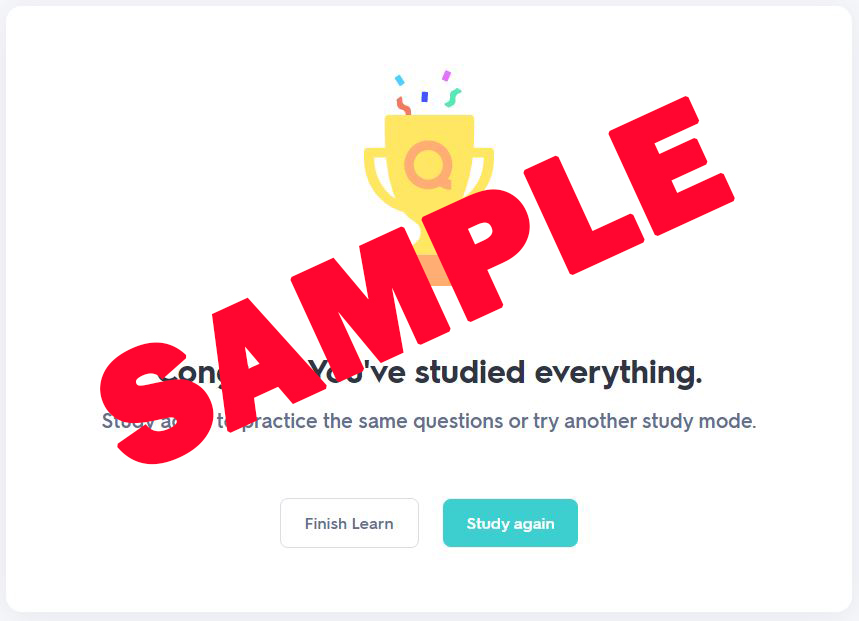

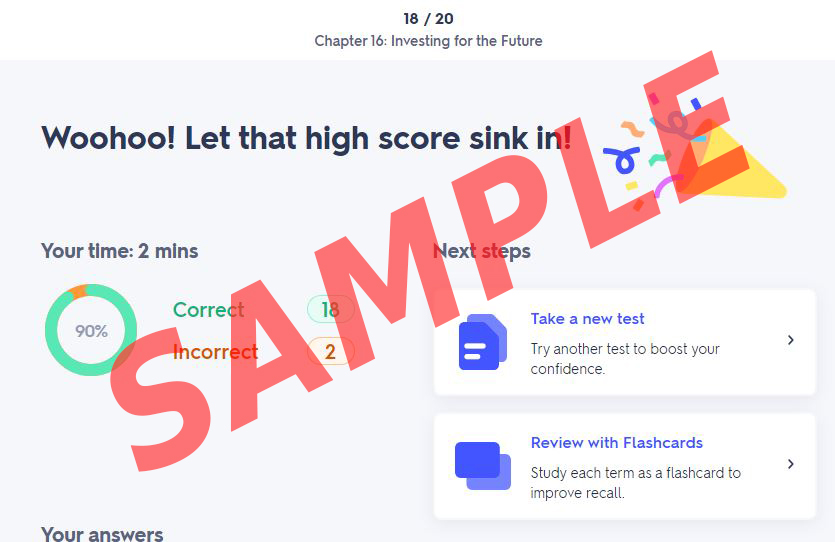

Quizlet Chapter 10: Problems with Credit

- Objective: Understand how creditworthiness is determined and the laws associated with the use of credit.

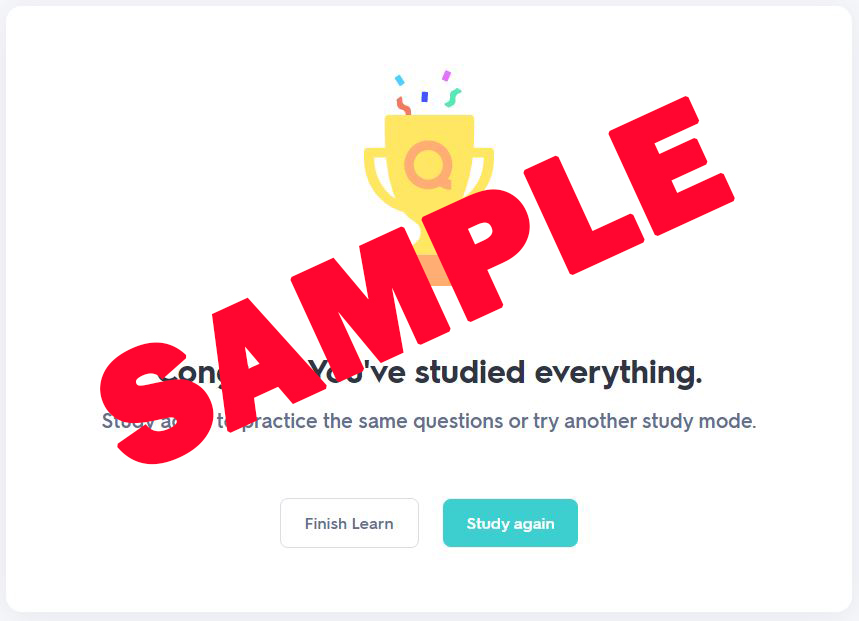

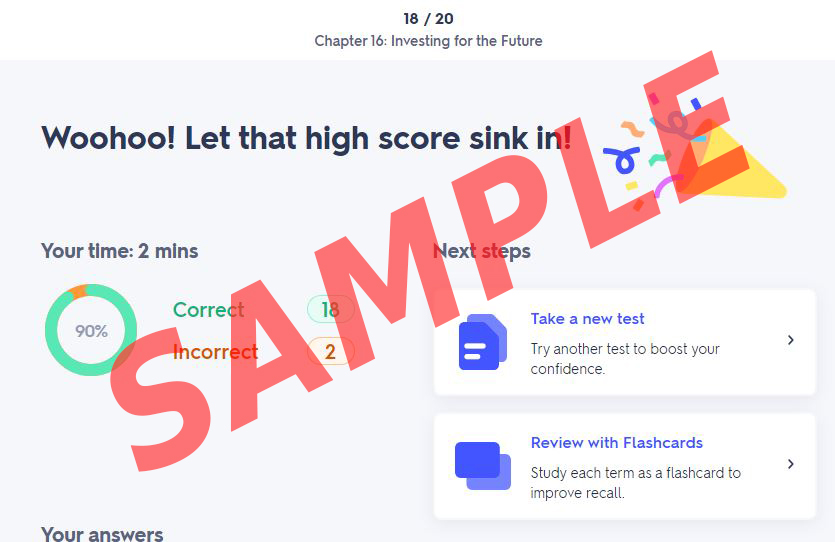

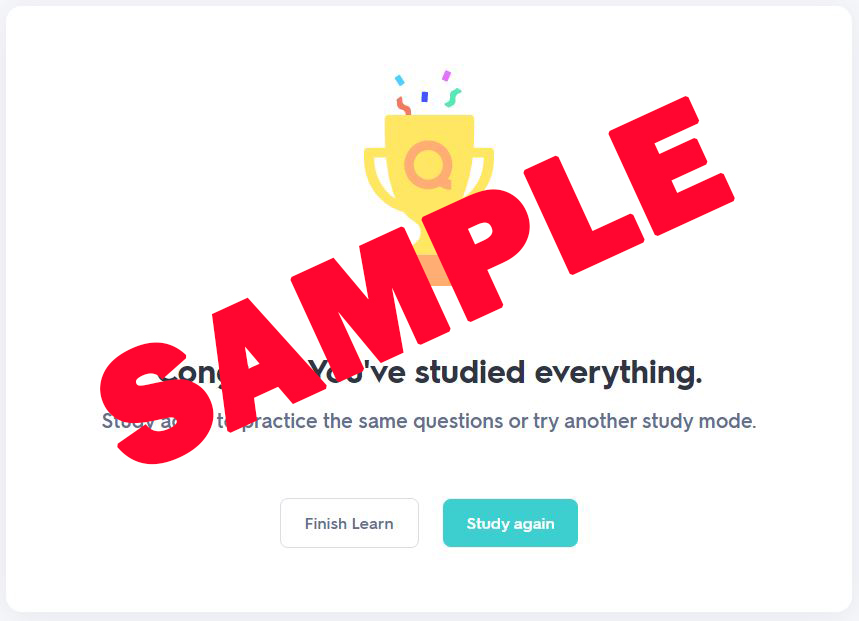

- SKIP ALL PERSONALIZATION STEPS at beginning.

- If you finish in less than 30 minutes you're settings are not correct and you will have to redo the learn.

- There will be a LONG quiz over the terms.

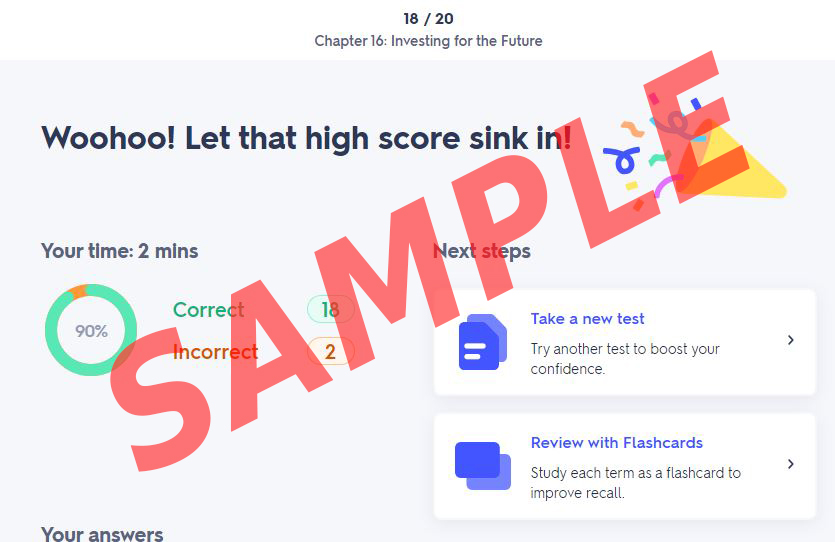

- You must complete the Learn, the Flashcards, the Matching and the Test. If you do not complete all sections then the test score will not count.

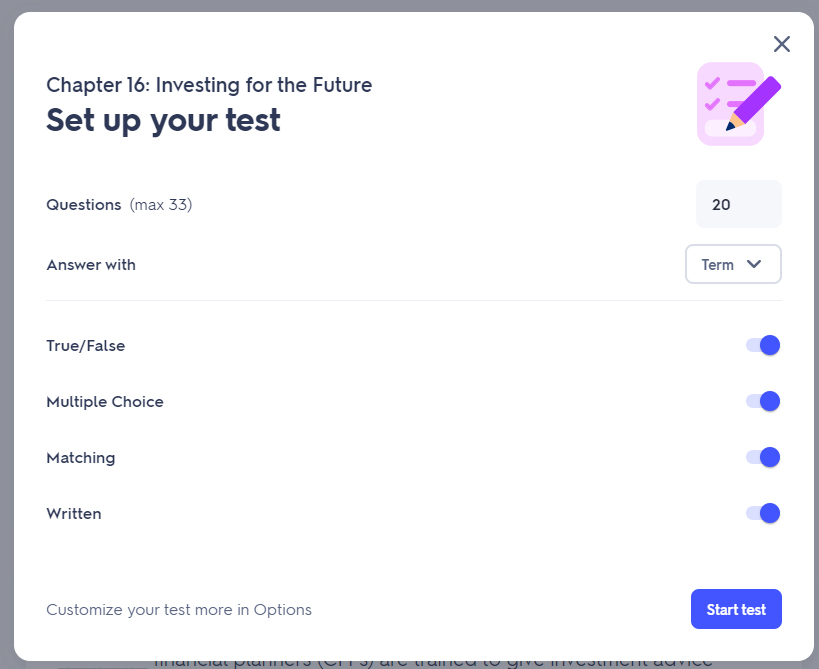

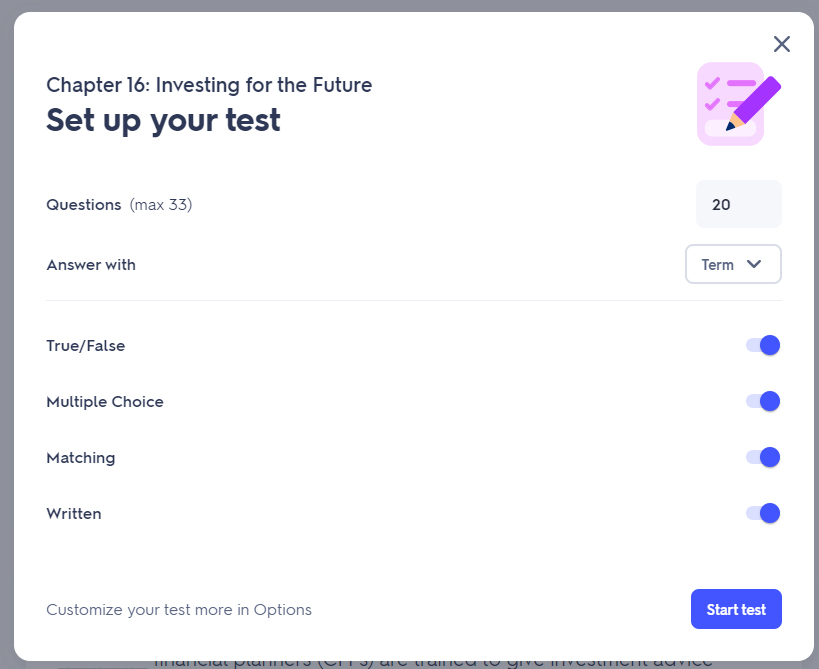

- In the Learn area, click Options on the top right. Your options must be set this way for your score to count. Answer with term only.

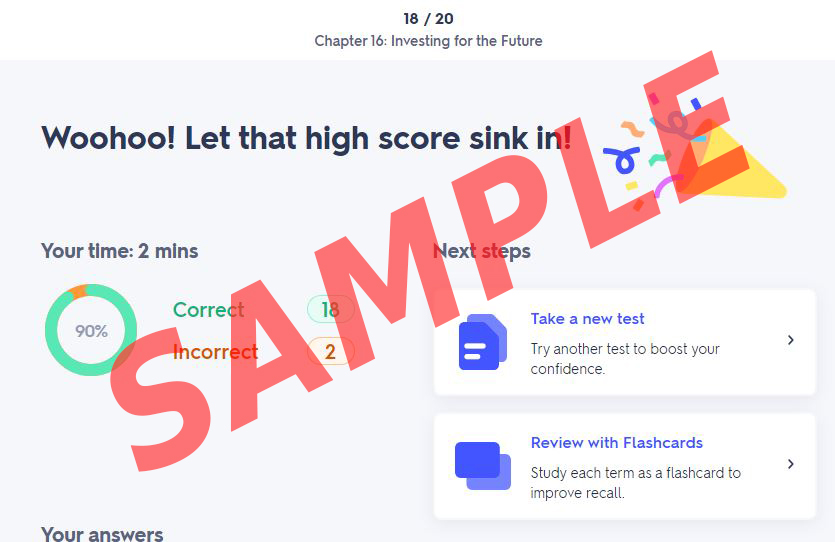

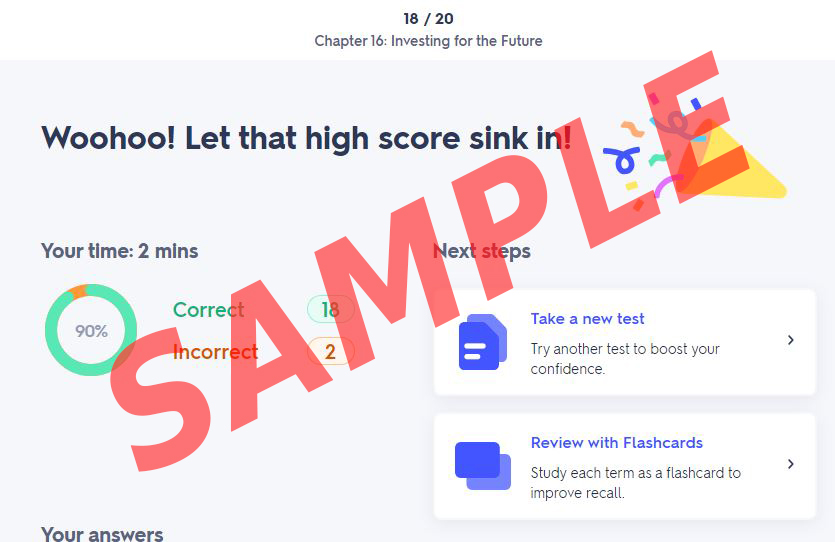

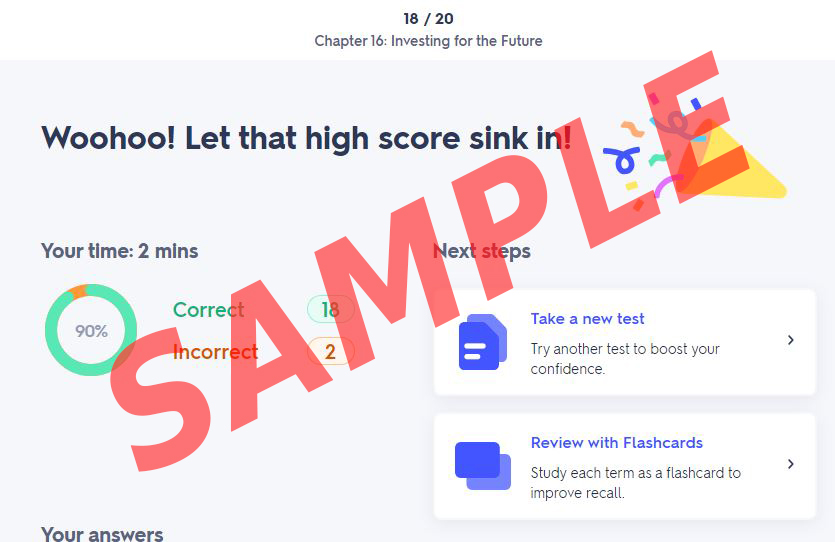

- You must complete the Learn section before taking the test. You must see the picture below.

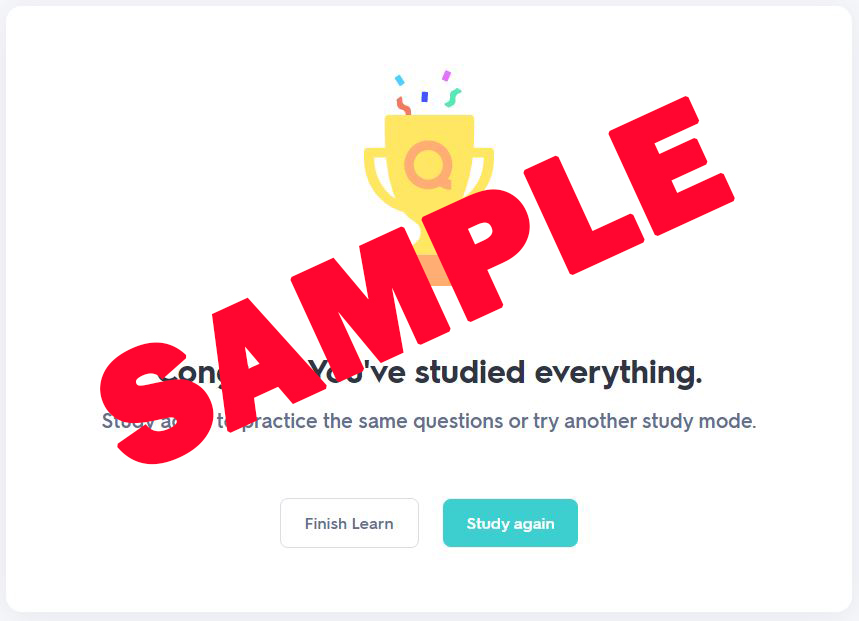

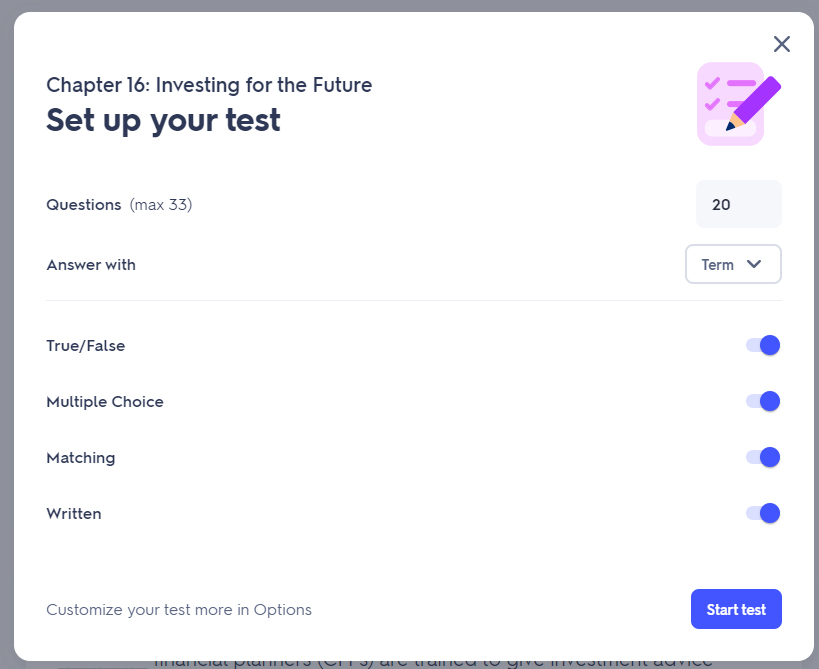

- For the test, change the test options to match the image below.

- Take the test without other tabs or answers open.

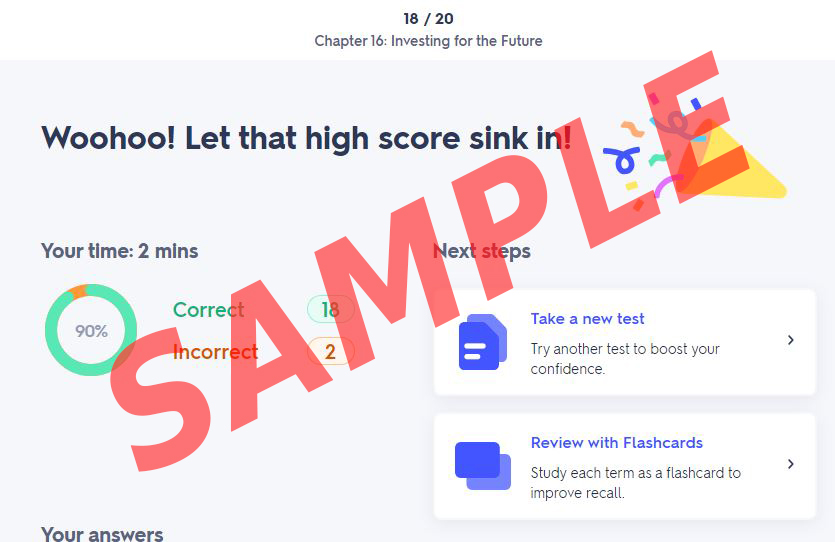

- Send me an email with a screenshot of your tests score. It should look like the image below. Include your Quizlet username in the message. Use the subject, Quizlet 10.

Apr 12

Chapter 9 Test: Cost of Credit in GC

- Use notes

Apr 11

Finish: Chapter 9 Quiz Costs of Credit

Chapter 8: Credit Records and Laws Math Calculations

- Objective: Understand how creditworthiness is determined and the laws associated with the use of credit.

- Basic interest/math calculations.

Chapter 9 Interest Calculations using Google Sheets

- Complete in Google classroom

- Explanation of functions

Apr 10

Chapter 9 Quiz Costs of Credit

Apr 8-9

Work from last week

Apr 5

Chapter 9 Workbook Pages 83-84

- Objective: Understanding how to use credit wisely and calculate the cost of credit.

- Use the provided chapter 9 notes to answer questions. Do NOT write on notes. Turn them back in when finished.

Apr 4

Interest Calculations Quiz 2

Apr 3

Interest Calculations Worksheet 1

- Objective: Understanding how to use credit wisely and calculate the cost of credit.

- Complete on paper

- Installment loan Calculation: https://youtu.be/hBGEYniGU6w?si=IYHqzJJDLnGOXkoI

Apr 2-3

Create charts

- Reopen your Stock Splits file in Google Classroom.

- Add a chart for EACH of the companies you selected.

- Each chart should plot the ending dollar value of the stock after each split.

- It works best if you select the data you want to plot and then insert the chart.

- Add titles to all axis, data labels, x-axis values and modify the appearance of the chart so it is more than the default settings.

- Sample Chart

Mar 27-28

Stock splits

- Objective: Increase understanding of the concepts of banking, investments, and financial markets

- Complete in Google classroom

- 2023 Video 1

- 2023 Video 2

- First, understand this calculation is not 100% accurate but gives you and idea of the effect of stock splits on your investment.

- Find the value of a $100 initial investment in any TWO of the following companies. Nike, Disney, Microsoft, Intel, Ford, Merck, Caterpillar, Procter & Gamble, McDonalds, Starbucks, Wal Mart.

- To do this you must find the price of the stock when it began trading for the first time. Get this price and then determine how many shares $100 would buy.

- Then find the stock splits over the trading history.

- The old prices and splits are available under the "Historical Data" link. Select MAX for the date range and Weekly for the frequency and then click apply.

- Determine the number of shares you would now own and multiply times the current market price.

- Calculations must be done using formulas.

- Do not submit until charts are complete.

- Sites to use:

- http://finance.yahoo.com/

- IPO investing article

- Splits can also be found at https://www.stocksplithistory.com/ but you would still need to look up the historical prices.

- $1000 invested in WalMart

- $1000 invested in Apple

Mar 26

DUE: Interest Calculation Quiz 3

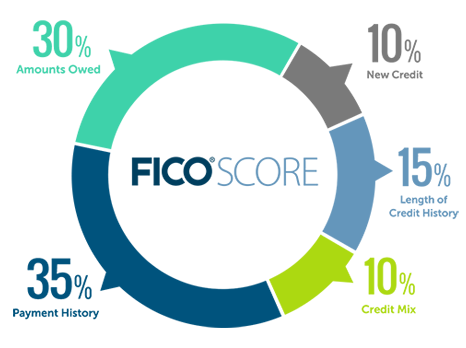

FICO Email

- Go to the myfico link below

- Send me an email telling me two specific items from the categories that comprise your credit score (NOT THE CATEGORIES THEMSELVES) and one thing not included in your credit score. (you need to read in detail to find this information.

- Please number the items 1-3.

- Please read all of the information on the page as there may be a quiz.

- Use the subject "FICO"

- https://www.myfico.com/credit-education/whats-in-your-credit-score

- Video: https://vimeo.com/221781256 (not required)

Mar 25

Interest Calculation Quiz 3

- Objective: Using I=PRT calculate loan terms and compound interest

Mar 22

Chapter 8 Workbook: Credit Records and Laws

- Objective: Calculate return on savings accounts and calculate compound interest.

- Pages 75-77, 82

Mar 21

Chapter 9 Workbook Pages 89-90

- Objective: Understanding how to use credit wisely and calculate the cost of credit.

- Perform some example problems as a class.

- Pages 89-90 Video

Mar 20

Complete Chapter 9 Workbook Pages 87-88

Mar 19

Quiz Chapter 9 Terms

- Objective: Understanding how to use credit wisely and calculate the cost of credit.

Chapter 9 Workbook Pages 87-88

- Objective: Understanding how to use credit wisely and calculate the cost of credit.

- Perform some example problems as a class.

- Pages 87-88 Video

Mar 18

Finish work from last week

Mar 15

Finish the following from the week:

- Quizlet Chapter 9: Costs of Credit

- Chapter 9 Workbook Pages 85-86

- Quiz: 5 Cs of Credit and credit laws on GC

The Dave Ramsey Show Video: Dave, I Disagree With Your Thoughts On Credit Cards

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Watch Video and complete the form in Google Classroom

- To turn on captioning. In Chrome click the 3 dots in the upper right, click settings, click Accessibility on the left, turn on Live Captioning.

Mar 14

Chapter 9 Workbook Pages 85-86

- Objective: Understanding how to use credit wisely and calculate the cost of credit.

- Perform some example problems as a class.

- Do not submit, show me for a grade and keep for notes.

- Page 86 video

Mar 13

Quiz: 5 Cs of Credit and credit laws on GC

- Use notes

Quizlet Chapter 9: Costs of Credit

- Objective: Understand how creditworthiness is determined and the laws associated with the use of credit.

- SKIP ALL PERSONALIZATION STEPS at beginning.

- If you finish in less than 30 minutes you're settings are not correct and you will have to redo the learn.

- There will be a LONG quiz over the terms.

- You must complete the Learn, the Flashcards, the Matching and the Test. If you do not complete all sections then the test score will not count.

- In the Learn area, click Options on the top right. Your options must be set this way for your score to count. Answer with term only.

- You must complete the Learn section before taking the test. You must see the picture below.

- For the test, change the test options to match the image below.

- Take the test without other tabs or answers open.

- Send me an email with a screenshot of your tests score. It should look like the image below. Include your Quizlet username in the message. Use the subject, Quizlet 9.

Mar 12

Chapter 9 Workbook Pages 85-86

- Objective: Understanding how to use credit wisely and calculate the cost of credit.

- Perform some example problems as a class.

- Do not submit, show me for a grade and keep for notes.

- Page 85 video

Mar 11

DUE: Loan Applications

- You will have the period to fix and resubmit your applications.

- Staple the new copy on top of the old.

Mar 1

Loan Applications

- We will go over your applications and I will give you the information to complete the application and the point system.

Feb 29

Loan Applications

- Need to be printed today even if you are not done.

Feb 27

No School-ACT Test

- Need to be printed today even if you are not done.

Feb 26-28

Work on Loan Application

Feb 21-23

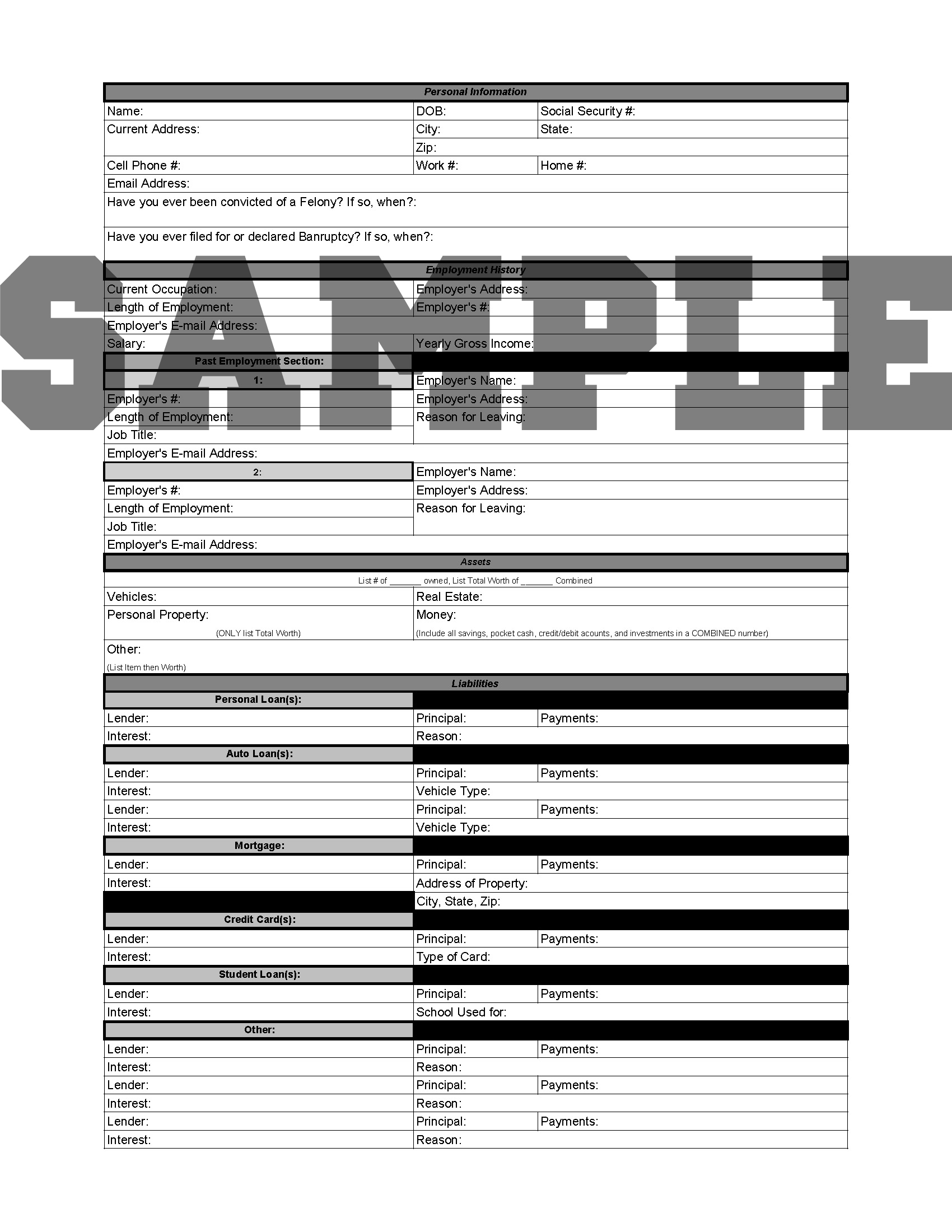

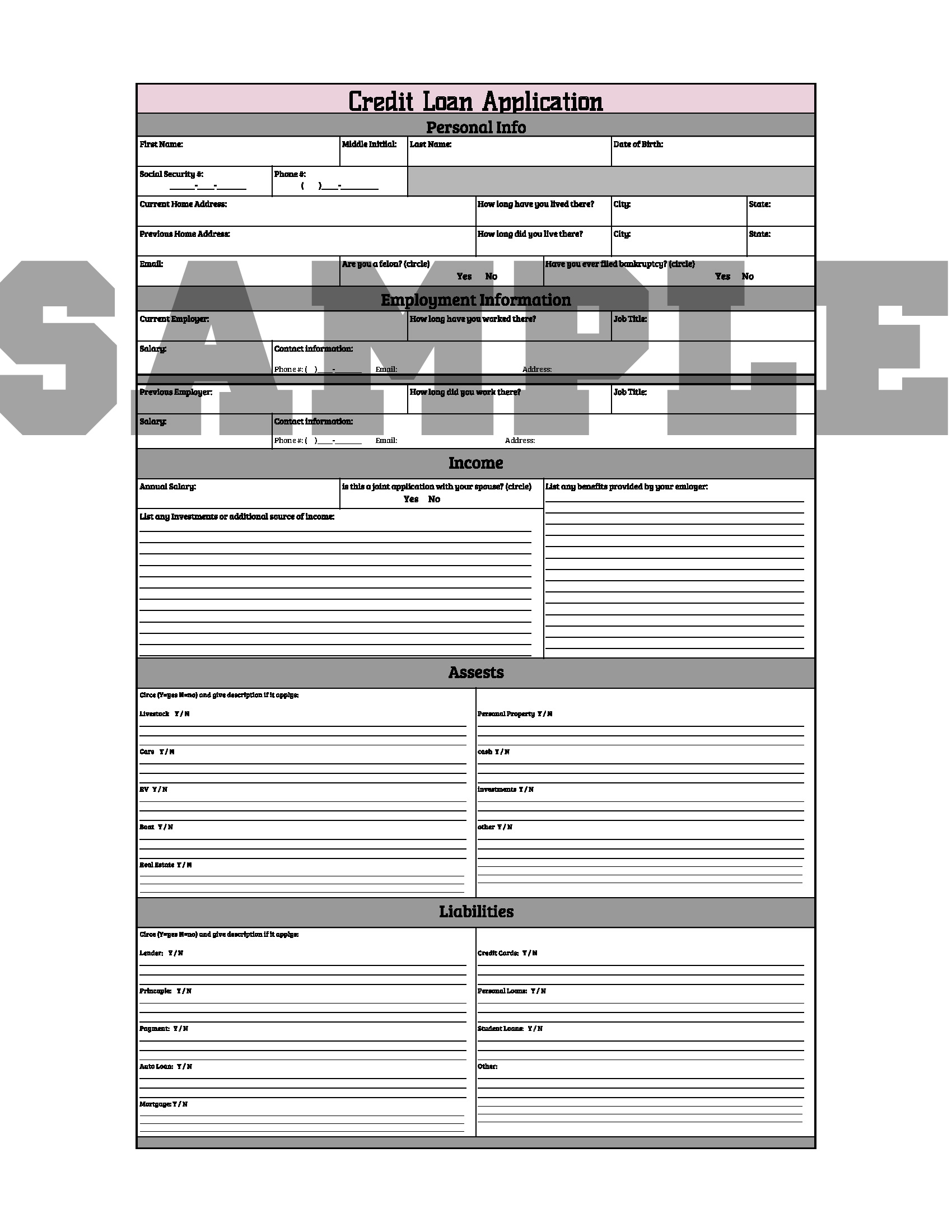

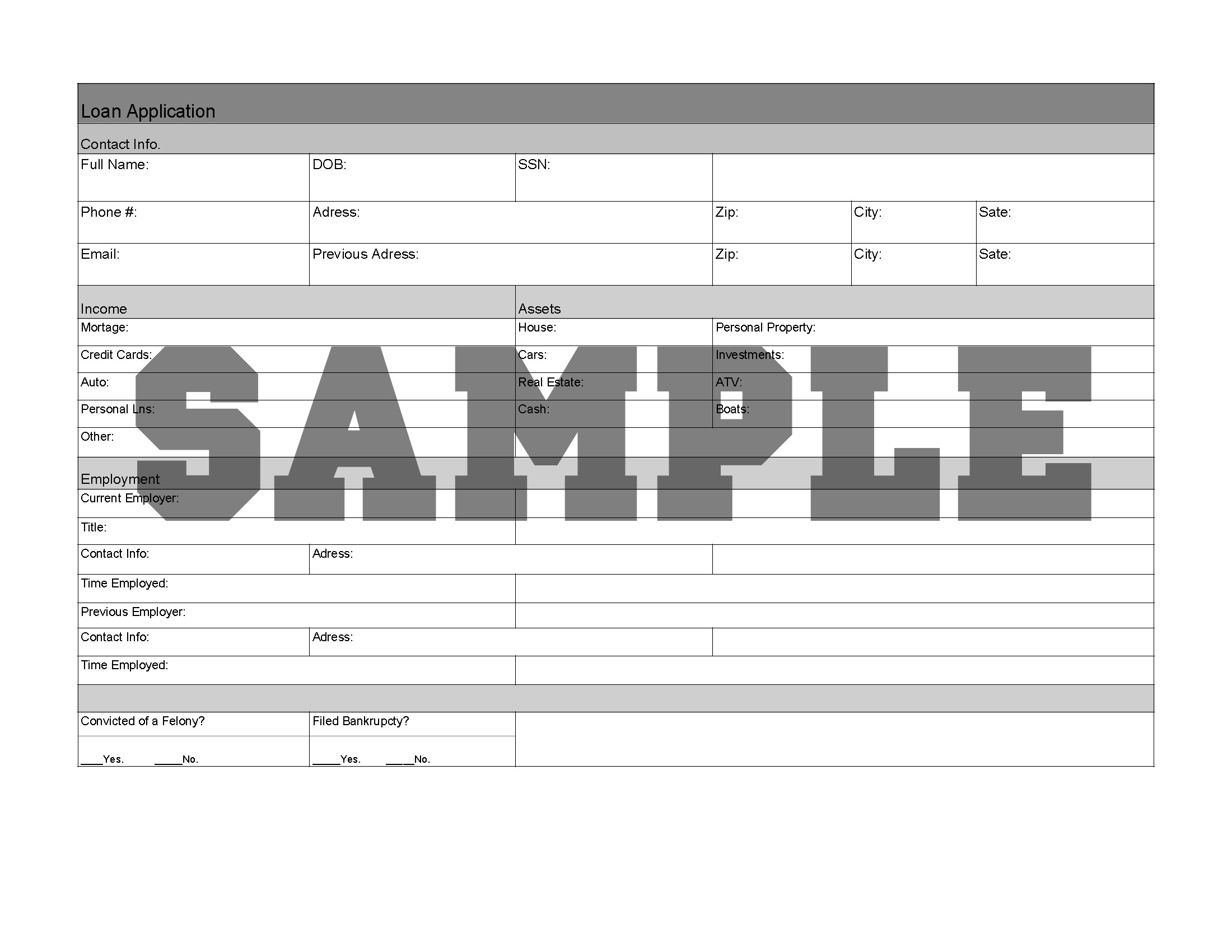

Loan Application (USE NEW SHEET IN 2024-2025)

- Objective: Understand how creditors determine creditworthiness. Increase understanding and utilization of spreadsheets.

- Video Explanation of Loan app and Point system in Google Sheets (2022)

- Video Explanation of what to include in the loan app (2023)

- To turn on captioning. In Chrome click the 3 dots in the upper right, click settings, click Advanced on the left, click Accessibility, turn on Live Captioning.

- Brainstorm for ways to evaluate 5 Cs on a loan application.

- Create a loan application using the notes from the 5 Cs of credit.

- Create the application in Google Classroom.

- Include at least the following sections:

- Personal information

- Current and previous address

- Current and previous employer

- Income

- Current debts and payments (include who it is owed to, amount owed and monthly payment)

- Assets

- References

- Purpose of loan

- Create a point system to determine creditworthiness. Go to 9:58 in the video for an example. This must include the following. Examples covered in a video that are not listed below should not be included; they are just examples.

- stability (length of time at a job or address),

- Monthly debt payments,

- Monthly income,

- total assets,

- total debt.

- bankruptcy (just subtract points for this),

- When printed, they must be a maximum of one page. The point system should be on its own page.

- If you are working from an example, DO NOT include information we did not cover in class.

- Appearance/Formatting matters.

- The information to complete the application will be provided in class. DO NOT FILL OUT THE APPLICATION until I give you the information.

- Before turning it in you must handwrite the following on the point system page and show the math:

- Score: using your point system.

- Net worth: Total Assets - Total Liabilities

- Disposable income = Monthly Gross income - Monthly debt payments

- Debt to Income Ratio = Monthly debt payments/Monthly Gross Income

- Print and submit the application and point system when you are done.

- Before submitting make sure you handwrite your name on the application.

- Complete the new application with the information provided in class.

- Show the score and the calculations above on the point system sheet.

- Staple the new version on top of the old one if you made changes.

- Submit.

- The examples below are NOT completely correct. Use them as a starting point but make sure you include all of the information we covered in class. To repeat, they all have something wrong with them.

Feb 20

Notes: 5 Cs of credit

- Video: Notes

- DTI Calculator

- https://www.lendingtree.com/debt-consolidation/whats-a-good-debt-income-ratio/

- https://www.lendingtree.com/home/mortgage/qualifying-for-a-mortgage-with-student-loan-debt/

Time finish work from last week...maybe

Feb 16

Quiz: Types of Credit

- Objective: Understand types of credit and its role in the economy

Email: Usury and Interest Rates

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Send an email to respinola@hcsdnv.com addressing the topic below. Use the subject, Usury and Rates.

- Find and submit the following information. Copy and paste the questions below into your email.

- Type your answer following each question not on the line below it. e.g., What is the best sports franchise? The New York Yankees.

- Use complete sentences and proper English.

- If you copy and paste from the internet (which is OK for this except for number 7), make sure all of the text has the same format. It should not look like this: What is the best sports franchise? The New York Yankees.

- What is the definition of usury?

- What is the usury rate for the State of Nevada?

- What is the federal funds rate (definition)?

- Who sets the federal funds rate?

- What is the prime rate (definition)?

- Who sets the prime rate?

- Why are the two rates (fed funds and prime) above important?

Feb 15

Chapter 7: Credit in America

- Objective: Understand types of credit and its role in the economy

- Page 67-68 Fill-in, True/False and Multiple Choice

- Use Chapter 7 Notes on Google Classroom

- If you're absent, Print pages 67-68

Feb 14

Notes: Chapter 7: Credit in the US

Notes: Chapter 8: Credit Records and Laws

- Objective: Understand types of credit and its role in the economy

- Video Part 2

Feb 13

Quiz: Chapter 7 Terms

Quiz: Chapter 8 Terms

Notes: Chapter 7: Credit in the US

- Objective: Understand types of credit and its role in the economy

- Video Part 1

Feb 8-12

Finish Chapters 7 and 8 in Quizlet

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Read: Sorry, Seniors, You Didn't Pay for (All of) That

- Pay attention to the bold items

- Answer the following: What can be done about Social Security and Medicare to secure it for your generation? How will this option work?

- Try googling, how to save social security.

- Support your stance.

- Use at least one FACT from the article.

- Do this by paraphrasing. Do not copy and paste. Do not quote directly. But you must still attribute.

- Use Grammarly and follow common rules of English.

- Send me an email to respinola@hcsdnv.com answering the above. Use the subject "Social Security"

Feb 8

Chapter 8: Credit Records and Laws

- Objective: Understand how creditworthiness is determined and the laws associated with the use of credit.

- SKIP ALL PERSONALIZATION STEPS at beginning.

- If you finish in less than 30 minutes you're settings are not correct and you will have to redo the learn.

- There will be a LONG quiz over the terms.

- You must complete the Learn, the Flashcards, the Matching and the Test. If you do not complete all sections then the test score will not count.

- In the Learn area, click Options on the top right. Your options must be set this way for your score to count. Answer with term only.

- You must complete the Learn section before taking the test. You must see the picture below.

- For the test, change the test options to match the image below.

- Take the test without other tabs or answers open.

- Send me an email with a screenshot of your tests score. It should look like the image below. Include your Quizlet username in the message. Use the subject, Quizlet 8.

Feb 6-7

Quizlet: Chapter 7: Credit in America

- Objective: Understand types of credit and its role in the economy

- SKIP ALL PERSONALIZATION STEPS at beginning.

- If you finish in less than 30 minutes you're settings are not correct and you will have to redo the learn.

- There will be a LONG quiz over the terms.

- You must complete the Learn, the Flashcards, the Matching and the Test. If you do not complete all sections then the test score will not count.

- In the Learn area, click Options on the top right. Your options must be set this way for your score to count. Answer with term only.

- You must complete the Learn section before taking the test. You must see the picture below.

- For the test, change the test options to match the image below.

- Take the test without other tabs or answers open.

- Send me an email with a screenshot of your tests score. It should look like the image below. Include your Quizlet username in the message. Use the subject, Quizlet 7.

Feb 5-6

Notes: Chapter 7: Credit in the US

Notes: Chapter 8: Credit Records and Laws

- Objective: Understand types of credit and its role in the economy

- Video Part 1

- Video Part 2

Finish Credit Cards in Google Classroom outside of class

Feb 2

Credit Cards in Google Classroom

- Objective: Understand types of credit cards.

- Complete in Google classroom

- Video Explanation

- Use the Internet to find five different credit cards from five different issuers that are targeted at young people (something you may have in a year or two).

- You can go to a bank, credit union or credit card site directly. Such as https://www.capitalone.com/credit-cards/; https://www.bankofamerica.com/; http://www.hcunv.org/; or https://www.chase.com/.

- Record the Institution (issuer), APR (not the intro rate), Fee, Grace Period, and Class/Type/Name.

- You will need to go to the terms and conditions.

- The grace period might be under how to avoid paying interest.

- DO NOT change the formatting of the table.

- Finish on your own, outside of class.

Feb 1

Quiz: Chapter 18 Bonds Terms

- Objective: Increase understanding of the concepts of the economy, banking, investments, and financial markets

Quarter 3 Pretest in GC

Jan 31

Quiz: Chapter 18: Bond Calculations

Jan 29-30

Chapter 18 Workbook p183-184: Investing in Bonds (review of investing options from Unit 3)

- Objective: Calculate return on different types of bond investments

Math Worksheet Page 43: Improper Fractions and Mixed Numbers

- Objective: Calculate equations using fractions and mixed numbers

Jan 26-29

Chapter 18 Workbook: Investing in Bonds

- Objective: Calculate return on different types of bond investments

- Page 185-187

- Explanation video 1

Jan 23-25

How time affects the value of money

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- 2022-2023 Video Explanation

- Complete in Google classroom: Directions are at the bottom of the sheet.

- Your totals should be the same as below. USE FORMULAS.

Value At Retirement $113,686 Value At Retirement $114,464 Less Total Contributions $20,000 Less Total Contributions $35,000 Net Earnings $93,686 Net Earnings $79,464

Jan 17

QUIZ: Return on Investment

- Objective: Calculate return on different types of stock investments

- Use all problems as notes to complete Quiz: Return on Investment

- Take home and complete by Monday.

Jan 16

DUE QUIZ: Return on Investment in Google Classroom

- Objective: Calculate return on different types of stock investments

What's wrong with the math?

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Read the article below. It is a typical post that circulates on social media.

- Send an email discussing what is wrong with the premise of the post. Why/how is their math wrong? Focus on what is wrong with their math. You MUST prove their math is wrong by including how much it actually equals in 40 years.

- Do this by finding a compound interest calculator online.

- Input their numbers for compounding $375 monthly over 40 years.

- The subject of the email must be "math".

- The usual standards apply.

- Spelling, grammar and punctuation check.

- Answer the question from above. State in your words. Do this by paraphrasing. Do not copy and paste. Do not quote directly. You must attribute if applicable.

Jan 12

Finish Quizlet Chapter 18

Makeup Work

Jan 11

QUIZ: Return on Investment in Google Classroom

- Objective: Calculate return on different types of stock investments

Jan 10

Chapter 17 Workbook: Investing in Stocks (review of investing options from Unit 3)

- Objective: Calculate return on different types of stock investments

- Page 169 Calculating return on stock investments

- Video: Page 169 Calculating return on stock investments

Jan 11 SKIPPED 2023-2024 but NEED TO DO

Correct and Return: Calculating Stock Return Worksheet from Jan 5

- Objective: Calculate return on different types of stock investments

- Done as a class.

- Video

Jan 9

Quizlet Chapter 18: Investing in Bonds (review of investing options from Unit 3)

- Objective: Calculate return on different types of bond investments

- SKIP ALL PERSONALIZATION STEPS at beginning.

- If you finish in less than 30 minutes you're settings are not correct and you will have to redo the learn.

- There will be a quiz over the terms.

- In the Learn area, click Options on the top right. Your options must be set this way for your score to count. Answer with term only.

- You must complete the Learn section before taking the test. You must see the picture below.

- For the test, change the test options to match the image below.

- Take the test without other tabs or answers open.

Jan 5-8

Calculating Stock Return Worksheet

- Objective: Calculate return on different types of stock investments

- Follow the directions.

- Use pages 167-168 to complete.

Jan 3-4

Chapter 17 Workbook: Investing in Stocks (review of investing options from Unit 3)

- Objective: Calculate return on different types of stock investments

- Page 167-168 Calculating return on stock investments

- Some of these will be done together

- Video explanation for page 167-168

Dec 18

Chapter 17 Workbook: Investing in Stocks (review of investing options from Unit 3)

- Objective: Calculate return on different types of stock investments

- Page 165-166 Fill-in, True/False and Multiple Choice

- Use Chapter 17 Notes on Google Classroom

- If you're absent, Print pages 165-166

Dec 15

Complete work from week

Holiday Crossword

Dec 13-14

Extra Credit Quiz: Must be in class

Article: Holiday Sales

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Article will post during class.

- Complete in Google classroom

Market Watch: Sell all holdings

- Objective: Increase understanding of the concepts of banking, investments, and financial markets

- Brief explanation of selling short.

- In Market Watch, sell all stock you own.

- You may have to wait until tomorrow for some of them to sell...mutual funds take a day to process.

- Reinvest all of your proceeds in ONE company. You can also sell short if you want.

- Do not exceed your available cash.

- Remember, you can also buy mutual funds.

- Send me an email stating what you bought and why.

- Your reasoning must include something specific we have learned in class and MUST answer the question WHY?.

- Stating, "I bought it because the PE ratio is high," is not suffcient.

- This means state a reason for the purchase. More than, "It seems like a good company."

- Use something from the stock quote but not the chart.

- Use the subject, Stock 12/13.

Dec 12

Quiz Chapter 17 Terms

Unit 3: Lesson 2: Inflation

Dec 11-12

Unit 3: Lesson 2: Inflation

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Explanation video

- Complete in Google Classroom

- Open the Google Sheet Unit 3: Lesson 2: Inflation

- Find the prices for the following items and calculate the amount of inflation or deflation.

- Make the table below in Google Sheets and enter the formula to calculate the percentage.

- The formula is the current price minus 1999 price divided by the 1999 price. For example, if the Toyota was 26,000 this year, the formula would be =(26000-17518)/17518. HOWEVER, DO NOT USE THE ACTUAL PRICES, USE CELL REFERENCES SUCH AS B5/C5.

- Apply formatting to the table to make it look professional.

- Create a chart that graphs the inflation percentages for each item.

- Chart Requirements

- Use either line or column chart

- X and Y axes Titles

- Chart Title

- Data Labels

- Modify chart appearance in terms of color and fonts.

- X Axis labels

- DO NOT submit it before completing the second part of the assignment (inserting the chart in a Google Doc). Check with me before doing so.

- After completing the second part, you must submit it in Google Classroom.

*The 1999 price is for a 2004 iPhoneProduct 1999

PriceCurrent

Price% Inflation/

DeflationToyota Camry LE 17,518.00 1 Gal. Reg. Gas-Local 1.30 Newspaper-Humboldt Sun .50 29" TV 2000.00 1st Class Stamp .33 iPhone-Base Model* 599 One lb of Hamburger 1.38 Nike/Jordan Basketball Shoe 135.00 Playstation 299.00 Jeans Levi 505's 36.99 Local Adult Movie Ticket 5.00 Milk 1 Gal. 2.88 1 Doz Eggs .96

- Open Unit 3: Lesson 2: Inflation Doc

- Insert the chart from the sheet into the doc as a link.

- Below the chart, write a brief explanation of why you think inflation happens and why some product prices increase more than others.

Dec 8

Compound Interest quiz 2

- Objective: Calculate return on savings accounts and calculate compound interest.

Dec 7

Chapter 17 Workbook: Investing in Stocks

- Objective: Calculate return on different types of stock investments

- Join Quizlet class if you have not

- You must complete the Learn section before taking the test. All terms must be mastered.

- Take the test without other tabs or answers open.

- Your test settings must be like the image below.

- Show me in class for a grade or send me an email with a screenshot of your tests score. It should look like the image below. Include your Quizlet username in the message. Use the subject, Quizlet 17.

Dec 6

Compound Interest using Google Sheets

- Objective: Calculate return on savings accounts and calculate compound interest using a worksheet and functions.

- Open "Calculate Compound Interest with Sheets" and complete in Google classroom

- To turn on captioning. In Chrome click the 3 dots in the upper right, click settings, click Advanced on the left, click Accessibility, turn on Live Captioning.

Dec 5

Compound Interest quiz 1

- Objective: Calculate return on savings accounts and calculate compound interest.

Complete any missing work

Bring back signed progress report

Dec 4

Unit 3 Test: Multiple Choice Section

- Use Google Classroom

- Use your notes.

- You must receive at least a 70%.

- Take your time!!

Chapter 6 Workbook: Saving for the Future

- Pages 57-58

Dec 1

Unit 3 Test: True False Section

- Use Google Classroom

- Use your notes.

- You must receive at least a 70%.

- Take your time!!

Chapter 6 Workbook: Saving for the Future

- Pages 57-58

Nov 30

Chapter 6 Workbook: Saving for the Future

- Objective: Calculate return on savings accounts and calculate compound interest.

- Explanation video

- Page 57 will be checked for completeness.

- Page 58 will be graded.

Nov 29

Chapter 16: Investing for the Future Workbook Page 159

- Objective: Distinguish investment and savings options

- Investment Risk Tolerance Assessment in Google Classroom.

- Click the link in the form to complete the assessment.

- Don't close the screen at the end as you need to upload a screenshot of it.

Nov 28

Chapter 16: Investing for the Future Workbook Pages 157-158

- Objective: Distinguish investment and savings options

- Use ONLY the Chapter 16 notes in Google Classroom

Nov 27

Chapter 6 Workbook: Saving for the Future, Pages 53-54

- Objective: Calculate return on savings accounts and calculate compound interest.

- Use notes in Google Classroom

Nov 16-17

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Read: 7 ways the Fed’s decisions on interest rates affect you

- We will go over the article together, briefly.

- Video Explanation

- Copy and paste the questions/statements below into an email. Answer each question following the question, not below it.

- What is the Federal Reserve Bank?

- Name one thing the Federal Reserve does.

- Who is the chairperson?

- What the Fed does matters because...

- Spelling and grammar check. State in your words. Do this by paraphrasing. Do not copy and paste. Do not quote directly. But you must still attribute.

- Send me an email to respinola@hcsdnv.com answering the above.

- Use the subject, Federal Reserve.

- https://www.cnbc.com/2023/11/01/fed-meeting-november-2023-.html

- https://www.hsh.com/indices/federal-funds-vs-prime-rate-mortgage-rates.html

Unit 3: Lesson 2: Worksheet 1: Comparing Savings Places

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Where to find information.

- Find the information from three different financial institutions. One must be a credit union.

- Explanatory video is embedded in the assignment.

- Complete in Google Classroom

Nov 15

Grade Unit 3 Review on Paper

Nov 13-14

Unit 3 Review on Paper

- Objective: Increase understanding of the concepts of the economy, banking, investments, and financial markets

- Use your notes

Nov 6-9

IN CLASS: Notes Unit 3 Savings and Investment Choices

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Savings options

- https://www.investopedia.com/terms/i/investmentpyramid.asp

- https://www.investopedia.com/articles/basics/03/050203.asp

- Notes Video 1

- Notes Video 2

- Notes Video 3

- Pyramid

Nov 3

Quiz: Chapter 6 and 16 Terms

Nov 2

Career Fair

Nov 1

Finish Chapters 6 and 16 in Quizlet

News

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Find a recent article about a business, industry, the stock market or the economy.

- Submit the following via email.

- Copy and paste the headline

- Copy and paste the url

- Maximum two sentence summary of the article in YOUR words.

- Two sentence response stating how the news will affect the stock price or the economy in general.

- Apparently it needs to be said...DO NOT PLAGIARIZE

- Use the subject, "news".

- Make sure Grammarly is turned on.

- Copy and paste following into your email. Yes, I want them numbered. Provide your answer following : not on the line below it. All formatting should be the same.

- HEADLINE:

- URL/ADDRESS:

- SUMMARY:

- OPINION:

- Example article (don't use it):

Why Lexicon Pharma Is Soaring By Chris Lange

September 9, 9:45 am EDT

Shares of Lexicon Pharmaceuticals Inc. (NASDAQ: LXRX) saw a handy gain on Friday after late-stage results came out. The company announced that its pivotal inTandem1 Phase 3 clinical trial of sotagliflozin met its primary endpoint showing a statistically significant reduction in A1C at 24 weeks in patients with type 1 diabetes on a background of optimized insulin.

Two primary safety concerns for patients with type 1 diabetes are severe hypoglycemia and diabetic ketoacidosis (DKA).

In the trial, the statistically significant and clinically meaningful improvement in A1C for both doses of sotagliflozin was achieved without an increase in severe hypoglycemia, one of the most prevalent serious health challenges in type 1 diabetes, which was seen less frequently in both treatment arms than placebo.

Oct 31

Finish Chapters 16 and 6 Quizlet

Oct 30

Quizlet: Chapter 16: Investing for the Future

- Objective: List and define investment options

- Join Quizlet class if you have not

- You must complete the Learn section before taking the test. All terms must be mastered.

- Take the test without other tabs or answers open.

- Your test settings must be like the image below.

- Send me an email with a screenshot of your tests score. It should look like the image below. Include your Quizlet username in the message. Use the subject, Quizlet 16.

Quizlet Chapter 6: Saving for the Future

- Objective: List and define savings options

- Join Quizlet class if you have not

- You must complete the Learn section before taking the test. All terms must be mastered.

- Take the test without other tabs or answers open.

- Your test settings must be like the image below.

- Send me an email with a screenshot of your tests score. It should look like the image below. Include your Quizlet username in the message. Use the subject, Quizlet 6.

Oct 26

Video: What the Heck ... Mutual Fund?

- Objective: Understand different types of mutual funds.

- Complete the form in Google Classroom

Quarter 2 Pretest in GC

Oct 25

Written Test Mutual Funds

- Objective: Understand different types of mutual funds.

- Use your notes

Oct 24

IN CLASS: Chapter 19 Workbook Pages 189-190

- Objective: Distinguish investment options

- Use ONLY the Chapter 19 notes in Google Classroom

- If you are absent, download and print the pages.

Oct 23

Mutual Fund Quiz

- You can use notes from class

- Complete in Google Classroom

Market Watch Evaluation

- Objective: Increase understanding of the concepts of banking, investments, and financial markets

- Go to Google classroom and complete the evaluation.

Oct 20

Buy a fund

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- There are many sites to find mutual fund information:

- Go to https://www.marketwatch.com/

- You will need to remember what you bought and some of the information about it for an assignment tomorrow.

- Spend a minimum of $10,000.

- You can sell something to get the money or buy on margin.

- Complete the assignment in Google Classroom.

Oct 18-19

Mutual Fund Research in Google Classroom.

- Objective: Use the internet to find information about mutual funds and differentiate between types of funds

- Submit when done. Do not share it.

- You must research four funds.

- There are many sites to find mutual fund information:

- Screener Video

Oct 16-17

Notes on mutual funds

Oct 13

Math worksheet pages 55

- Objective: Divide fractions and mixed numbers

Oct 12

End of class, QUIZ: Chapter 19 Terms

Time to finish Quizlet: Chapter 19

Oct 11

Quizlet: Chapter 19 Investing in Mutual Funds, Real Estate and Other Choices

- Objective: List and define basic risk management terminology.

- DO NOT send a request to join the class.

- Join Quizlet class

You must complete the Learn section before taking the test. This means to receive a grade for the test you must show that you covered all of the items in the Learn area.

- When you are done with the Learn you should see the image below.

- Take the test without other tabs or answers open. This must be done in class.

- DO NOT change the test settings

- Show me for a grade.

Oct 10

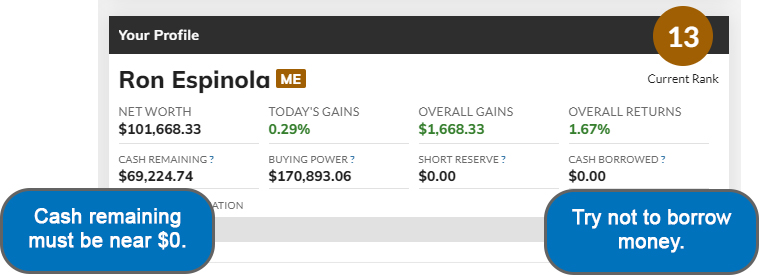

COMPLETE Final Check your investments

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Do at least some research.

- Invest all of your remaining money.

- You need to diversify (spread your money around) and DON'T PUT ALL OF IT IN ONE COMPANY.

- Spend about $5000-10,000 for each company you buy.

- This means you should have approximately 10-20 compaies in your portforlio.

- Upload a screenshot of your portfolio in the form in Google Classroom.

- You can do this by

- You can use the Snipping Tool and save the image to the desktop.

- Click the "prt scr" key which copies the computer's display. You must then save the image using Photoshop. Create a new file in Photoshop. Paste your image into it. Save it to the desktop as a jpg. Upload the file to the form.

- Or you can take a picture with your phone save it send it to yourself and then use Add file in the form.

- Chrome OS To take a screenshot on a Chromebook:

- Press Ctrl + switch window. (For non-Chrome OS keyboards, press Ctrl + F5.)

- Your screenshot is saved as a PNG file in your "Downloads" folder.

- https://www.theverge.com/2020/1/14/21065295/chromebook-screenshots-how-to-take-keyboard-keys

- http://www.marketwatch.com/game/

Oct 9

COMPLETE Work from Friday

Oct 6

Quiz: How financial Markets Work

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Complete in Google Classroom

- Use your notes

Oct 5

Article: Securities Fraud: Use form in Google Classroom

- Find an example of securities (investment) fraud or insider trading from a recent news article and complete the form in Classroom.

- Do not use Bernie Madoff, Martha Stewart or Michael Milken.

- The article must be from some time in the last two years.

Article: Investing Advice

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- 3 things you should never do when the stock market tanks

- Complete in Google Classroom

Oct 4

Invest in another company: Health Services

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Go to https://finance.yahoo.com/screener/

- I will show you how to use the screener on Yahoo Finance. Others include:

- https://www.marketwatch.com/tools/screener/stock OR

- https://finance.yahoo.com/screener/new OR

- https://www.cnbc.com/stock-screener/

- Choose one of the companies to invest in.

- Spend around $10000.

- http://www.marketwatch.com/game/

- Copy and paste the following into your email.

- Company:

- Reason:

- Send the email to respinola@hcsdnv.com.

- Use the subject "Health Services".

- You must specifically mention one item from the stock quote related to profitability as the reason for making the purchase. For example, I chose Cigna because its earnings growth was 22 and 32 percent in the last two years making it a profitable and growing company.

Oct 3

Complete Notes Worksheet

- Objective: Increase understanding of financial markets

- Complete questions on the front.

- Show me when done.

Unit 2 Handout in Google Classroom

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial market.

Sep 29-Oct 2

Notes: Unit 2 How financial Markets Work

- Objective: Increase understanding of financial markets

- Take notes on back of the worksheet.

- Complete questions on the front.

- Show me when done.

- Notes Video 1

- Notes Video 2

Sep 28

DUE: US Expenditures Chart in Google Classroom

Math Worksheet 50

- Objective: Subtracting fractions

- Must be done in class without your phone.

Sep 25

US Expenditures Chart in Google Classroom

Invest

- Buy one more company in Market Watch.

- It must be a financial related company such as a bank, insurance, broker, investment house.

- Invest $5000-10,000

- Show me your portfolio for credit.

- You need to be holding at least four companies.

Sep 22

Quiz: Financial Planning

- Objective: Understand how decisions affect financial planning

- Use Notes

- Complete in Google Classroom

Sep 21

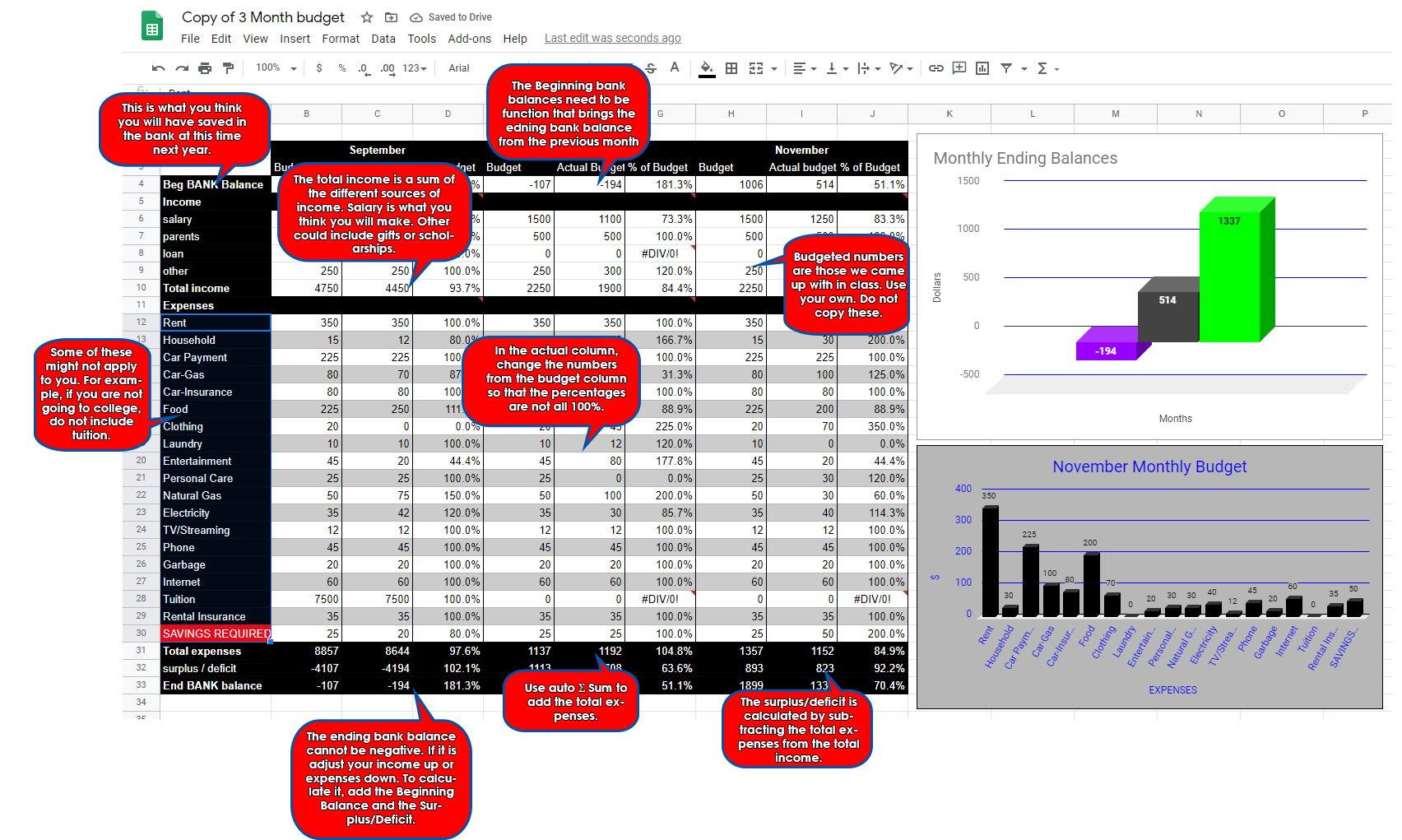

Complete Budget and Charts

- Objective: Develop a household budget

- Together we will insert a chart that tracks your ending balances for each month.

- The chart must have appropriate titles, labels, and formatting.

- Video for this chart

- Add another chart which plots the Actual Expenses for one of the months.

- Add appropriate labels, you must have labels for the expenses, titles and formatting to change the chart from default settings

- SUBMIT

Sep 14

Budgeting

- Objective: Develop a household budget

- Go over average expenditures, take notes to develop personal budget. Scroll down for video of notes

- 2021 Average Household Expenses

- 2019 Average Household Expenses

- 2018 Average Household Expenses

- 2016 Average Household Expenses

- Reference Article: 09-13-20 Average Household Budget

- Average Car Insurance Rates by Age and Gender

- In Google Classroom open the budget file and begin creating your budget.

- Only complete three months.

- Input the budgeted items using the numbers we came up with in class.

- You must use the income categories from your notes and/or the example budget below.

- For the expense categories, follow the example. But if we covered an expense in class, it must be included.

- Gas and oil, auto maintenance, renters insurance, subscriptions, medicine, savings, personal care, pets

- Vary the actual numbers from the budget amounts.

- For school related costs, go to the site of the college you think you will attend.

- The beginning balance is what you think you will have in the bank when you graduate from high school.

- The ending balance for one month is the beginning balance for the following month. This will be a formula.

- The whole budget is linked together using formulas. So if your income is changed in September, it changes the ending balance for November.

- FORMULAS:

- TOTAL INCOME: all income sources added together using Auto Sum this is using the Sigma (Σ).

- TOTAL EXPENSES: all expenses added together using Auto Sum.

- MONTHLY SURPLUS: TOTAL INCOME-TOTAL EXPENSES

- ENDING BALANCE: BEGINNING BALANCE+MONTHLY SURPLUS

- % OF BUDGET: ACTUAL / BUDGET and change formatting to %.

- Video for functions 1

- Video for functions 2

- Video for final functions and formatting

- Once you input all of the formulas for the first month you can then copy and paste them and the budget amounts to the next two months.

- Vary the numbers for each month. This means your budget and actual amounts for food should not be the same for each month.

- When all of the formulas are input, format the text and cells to change the appearance; make it look good.

- Insert a chart that tracks your ending balances for each month.

- The chart must have appropriate titles, labels, and formatting.

Sep 11-14

Notes: Unit 1 Financial Decisions

- Objective: Understand how decisions affect financial planning

- Notes

- Video day 1

- Video Day 2

- Video Day 3 Expenses for Budget

- Video Day 4 Expenses for Budget

- Complete handouts (Print if absent)

- Goal sheet

- Net Worth

- Income and Expenses

Sep 7

Find a possible career

- Objective: Preparing to apply for a job (e.g., complete personal aptitude and interest inventories, performing a job search, developing a résumé, preparing for an interview).

- Go to https://www.123test.com/career-test/

- Others (not required) https://www.truity.com/test/holland-code-career-test and https://www.bls.gov/ooh/occupation-finder.htm

- Video Explanation

- Complete the questionnaire. Use as much detail as possible.

- Select one of the career fields you are interested in.

- Use the Snipping Tool to capture the information and paste it into the body of an email. This will look something like:

- Send an email to yourself with the information you have copied.

- CC me on the email.

- The subject should be, Career Aptitude Test Results.

- Answer the following, does this match with something you would want to do? Why? Why not?

Sep 6

Video: What is a Stock Market Index by Wall Street Survivor

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Complete in Google Classroom

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Video explanation

- Find a certain sector of the economy and invest in a the company.

- Go to https://www.marketwatch.com/ click on Dow and then sectors.

- Select one of the industries to find companies that are in it.

- Choose one of the companies to invest in.

- Spend between $5000-$10,000.

- http://www.marketwatch.com/game/

- Copy and paste the following into your email. Answer each following the colon.

- Sector/Industry Definition:

- Company:

- Sector/Industry:

- Reason:

- Send the email to respinola@hcsdnv.com.

- Use the subject "Sector".

- For the reason, you must specifically mention one item from the stock quote as a reason for making the purchase and why it makes it a good investment. Check grammar and spelling.

Sep 5

DUE: Article: CVS, Walmart and Walgreens ordered to pay $650.6 million to Ohio counties in opioid case

Video: How the Stock Market Works

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Complete in Google Classroom

Make second purchase in Market Watch

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Spend about $5000 on one stock.

- It must be one of the companies included in the DJIA. To find one of these:

- Go to https://www.marketwatch.com/

- Click on Dow

- Scroll down and you will see components on the left side.

- Video Explanation

- Go toGo to https://www.marketwatch.com/games/lowry-cf-2023-2024/ to purchase the stock.

- Complete the form in Google Classroom.

Aug 31

Article: CVS, Walmart and Walgreens ordered to pay $650.6 million to Ohio counties in opioid case

- Objective: Increase understanding of the concepts of the economy, banking, investments, and financial markets

- See directions in Google classroom

DUE: Math Worksheet Page 34

Aug 30

Complete first stock purchase and send email

Math Worksheet Page 34

Aug 29

Quiz: Stock Quotes

Make first purchase in Market Watch

Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets- Spend about $5000 on one stock.

- Go to https://www.marketwatch.com/games/lowry-cf-2023-2024/ to purchase the stock.

- Send me an email explaining why you made the investment. respinola@hcsdnv.com.

- I invested in ________________ because ___________________.

- You must include one reason based on information from the stock quote.

- Use the subject "Stock 1".

- Video Explanation

Aug 28

DUE: Stock Quotes Research

Assignment: What is Stock Video

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Complete in Google Classroom

- To turn on captioning. In Chrome click the 3 dots in the upper right, click settings, click Accessibility on the left, turn on Live Captioning.

- https://youtu.be/7EUbrFLef7M?si=JBB0ej5lpRUozw87

Aug 25

Stock Quotes Research

- Objective: Increase understanding of the concepts of the economy, banking, investments, and financial markets

- Researching companies by industry, sector or trending stock.

- Look up the quotes for five companies and record the information in the sheet in Google Classroom.

- Video Explanation

Pretest

- Take the pretest in Google Classroom.

- Must be done at school.

- Do not look up answers.

Aug 24

IN CLASS: Go over stock quotes

- What is a good investment

- Take notes

- Day one video

- Day two Video

Aug 23

IN CLASS: Go over stock quotes

- What is a good investment

- Take notes

- Day one video

- Day two Video

Aug 22

Assignment: Market Levels

- Complete in Google Classroom

Complete registration for all required sites

Aug 21

Course requirements/expectations

- Syllabus: parents can sign ther verfication or email me at respinola@hcsdnv.com.

Student Syllabus Verification

- Complete in Google Classroom

Register for Market Watch

- Objective: Increase understanding of the concepts of banking, the economy, investments, and financial markets

- Go to https://www.marketwatch.com/games/lowry-cf-2023-2024/

- Click Join Game.

- Sign up with Google.

- Click the game link again: https://www.marketwatch.com/games/lowry-cf-2023-2024/

- use the PW lowrycf2023!

Join Quizlet

- https://quizlet.com/join/NDcrvMe24?i=1ucocb&x=1rqt

- Use your real name for your Quizlet account so you can receive credit.